Financial services companies use a mix of digital, operational, financial, and customer-focused strategies to expand into new markets and drive growth.

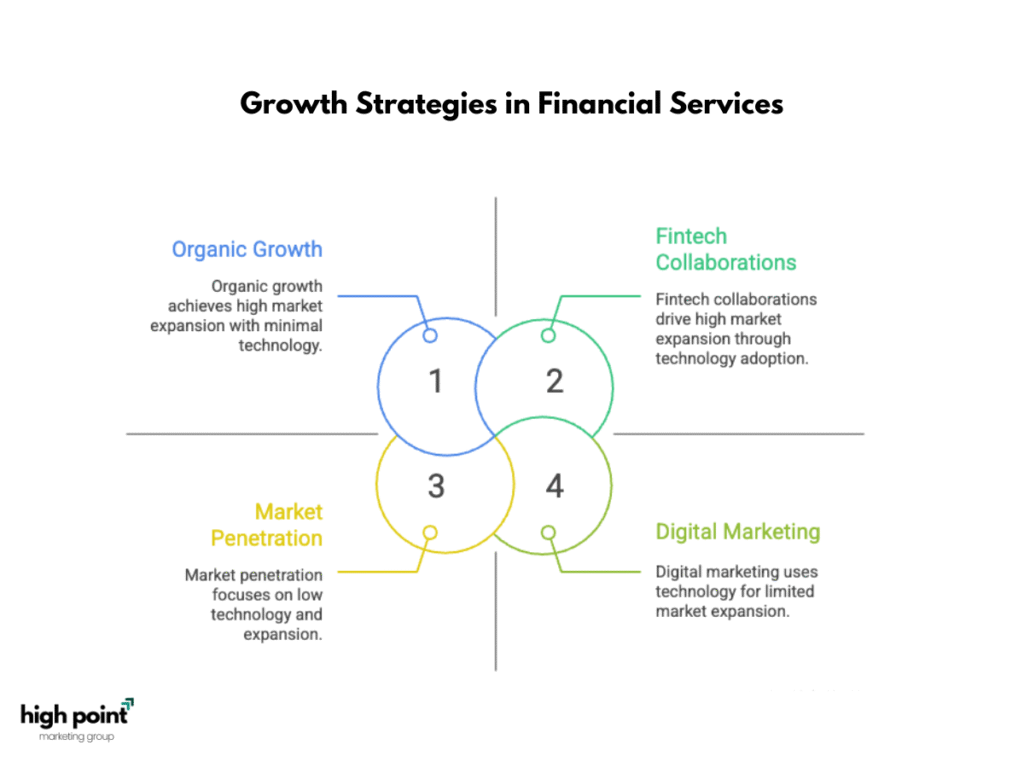

Key Growth Strategies:

| Strategy Type | Approaches |

| Core Expansion | Market penetration, market development, product development, and diversification |

| Digital | Social media marketing (+10% ad spend in 2024), marketing automation, SEO, mobile, and web integration |

| Operational | Organic growth, mergers & acquisitions (M&A), entering new territories |

| Financial | Private equity, crowdfunding, and financial efficiency |

| Customer Strategy | Educational content, personalized engagement, and customer-centric offerings |

Aligning marketing with finance and using data-driven insights are also crucial for identifying and executing successful market expansion.

How does technology adoption fuel market expansion for financial services?

Technology adoption improves efficiency, speeds product launch, and expands access to new markets. AI, cloud computing, and fintech solutions enable firms to scale digitally, reducing reliance on physical branches. This drives cost reduction, greater customer reach, and financial inclusion.

EY and CGI report that AI integration boosts growth and efficiency, while McKinsey shows fintechs grow 3x faster due to tech innovation. Overall, technology fuels competitive advantage and market expansion in financial services.

What role do fintech collaborations play in market expansion for financial services?

Fintech collaborations accelerate innovation and speed up product development, enabling financial institutions to access new and underserved customer segments. These partnerships improve efficiency, customer experience, and allow expansion of services without heavy physical infrastructure.

Key points:

- 84% of fintechs partner with traditional banks (World Economic Forum, 2025).

- Partnerships help with financial inclusion and reduce barriers for startups.

- Collaboration combines fintechs’ technology and agility with banks’ scale and regulatory expertise.

- They enable faster digital product launches and broader market reach.

- Alliances foster innovation while ensuring regulatory compliance (EY, 2024).

Fintech collaborations create a synergistic ecosystem that drives market growth and financial inclusion.

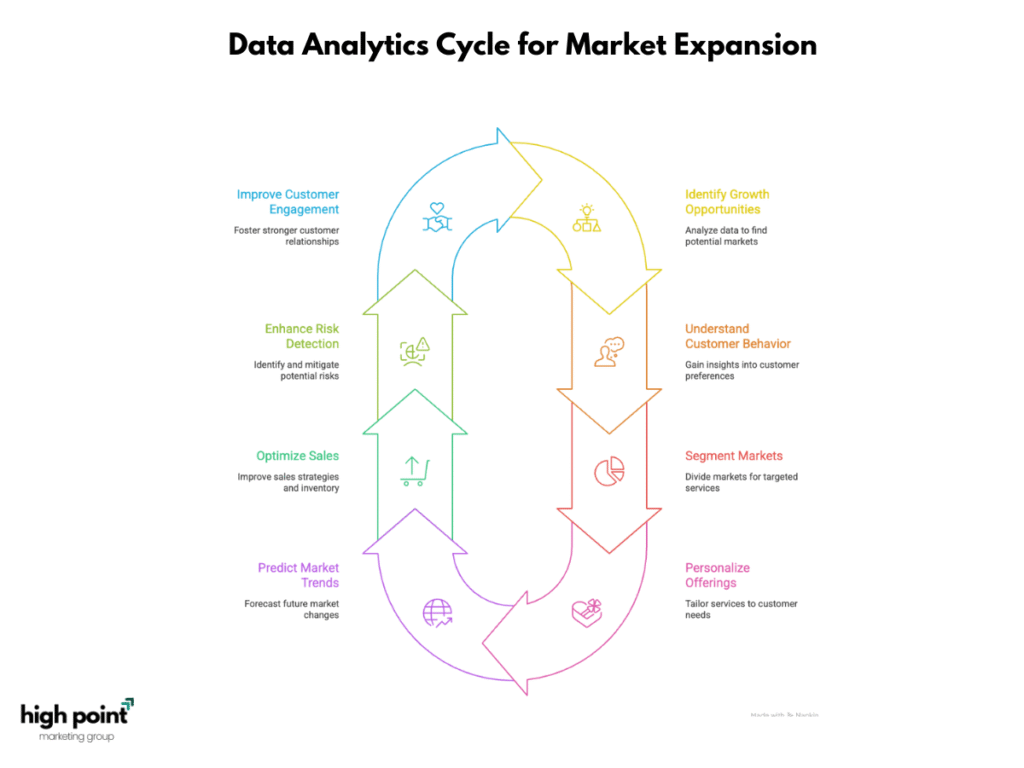

How can data analytics be leveraged for market expansion in financial services?

Data analytics helps financial firms identify growth opportunities by understanding customer behavior and segmenting markets for targeted services. It supports risk management, predictive forecasting, and compliance, improving decision-making and reducing losses. Using AI and big data, firms personalize offerings, accelerate product development, and spot market trends. Analytics also uncovers underserved segments, boosting financial inclusion and competitive advantage.

Key benefits:

- Predict market trends and unmet needs

- Optimize sales and inventory

- Improve risk detection

- Enhance cross-selling and upselling

- Support personalized, scalable services

This enables strategic expansion and better customer engagement.

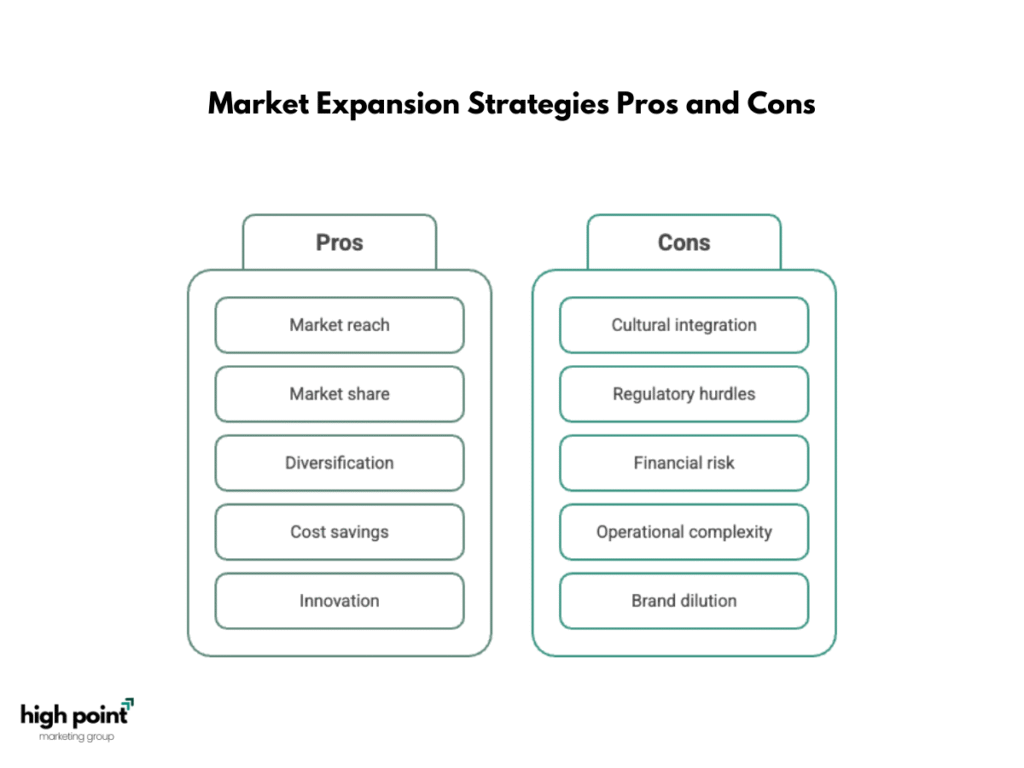

Should you consider mergers and acquisitions for market expansion in financial services?

M&A is a powerful strategy to quickly expand market reach, increase market share, and diversify services in financial services. It helps firms achieve cost savings, scale operations, and access new technologies. About 37% of CFOs see M&A as key to growth. However, risks like cultural integration and regulatory challenges require careful management. For SMEs, M&A is crucial to avoid stagnation and drive growth.

In short, M&A can fast-track market expansion if done with proper planning and risk control.

Why is customer experience critical for successful market expansion in financial services?

Customer experience (CX) is critical for market expansion in financial services because it drives loyalty, satisfaction, and retention, boosting revenue by up to 20-27.5%. CX acts as a key differentiator in a competitive market by delivering seamless, personalized experiences that strengthen brand reputation and attract new customers. Poor CX causes churn and lost revenue, hindering growth. Tailored CX strategies and digital innovations further support sustainable expansion.

Key Facts:

| Fact | Source |

| Revenue can grow up to 20% with positive CX | Five9 (2024) |

| Banks see up to 27.5% growth from improved CX | Qualtrics |

| 72% of customers value personalization highly | Zendesk |

| 83% of firms say CX is critical for future success | The Financial Brand |

| Companies focusing on CX are 60% more profitable | Deloitte |

| Poor CX costs U.S. companies $75 billion annually | Quora |

Strong CX is essential for financial firms to expand successfully and grow sustainably.

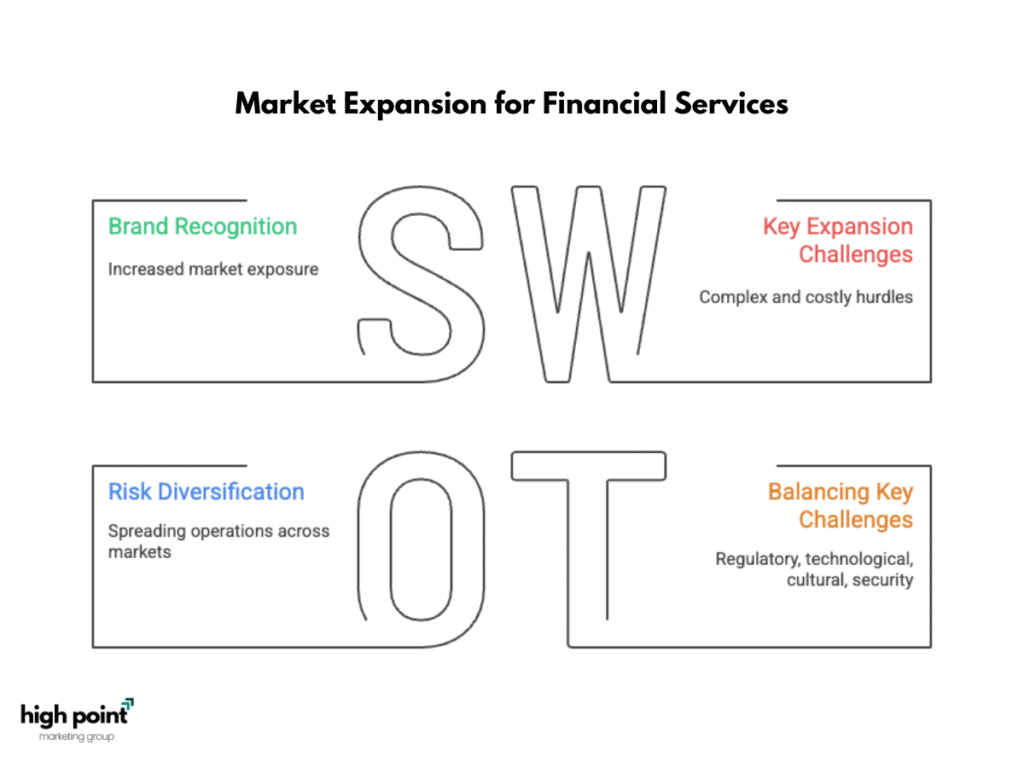

What are the key benefits of market expansion for financial services?

Key Benefits of Market Expansion for Financial Services

- Access new customers and revenue streams by entering untapped markets.

- Diversify products, services, and risks to reduce dependency on one market.

- Achieve economies of scale to lower costs by 10-20%.

- Tap into global talent and resources to boost innovation and service quality.

- Enhance brand recognition and competitive position.

- Support sustainable growth through markets with strong GDP and skilled labor.

- Leverage financial incentives and partnerships in new regions.

- Mitigate risks by diversifying geographically.

Market expansion drives growth, efficiency, innovation, and resilience for financial services firms.

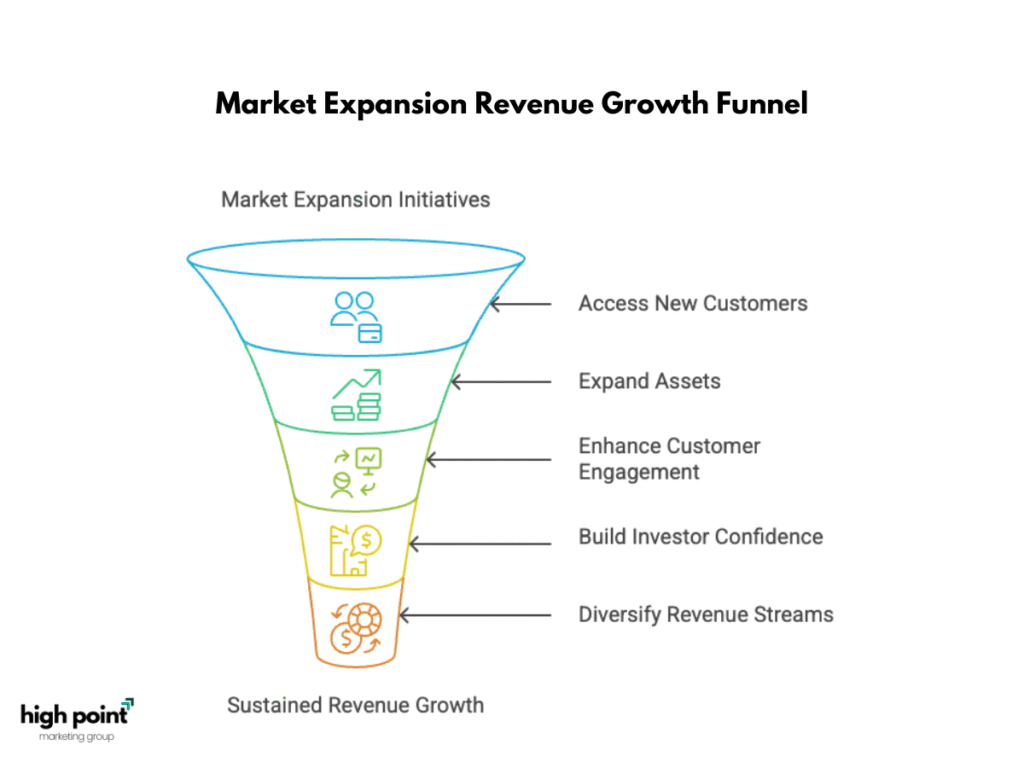

How does market expansion for financial services lead to increased revenue?

Market expansion for financial services increases revenue by tapping new customer segments and broadening the market. It grows market share and diversifies revenue streams through new products and services. Expansion also boosts customer engagement and cross-selling, driving more sales.

Key facts:

- Entering new markets accesses untapped customers (Ontop, Centus).

- Expanding assets leads to more loans, deposits, and revenue (Partnership for Progress).

- Cross-selling raises revenue without new customers (Latinia).

- Revenue growth builds investor confidence, enabling further expansion (Stripe).

- Diversification improves profitability (Preferred CFO).

In short, market expansion broadens reach, reduces risk, and enhances competitive advantage—all fueling sustained revenue growth.

In what ways does market expansion for financial services enhance brand recognition?

Market expansion for financial services enhances brand recognition by providing increased exposure in new locations and allowing firms to build trust and positive relationships. Through strategic marketing and tailored campaigns, companies can align public perception with their desired brand image. Partnerships with fintechs and local organizations open new channels for brand awareness, while digital and geographic growth strengthen brand identity and customer perception. Consistent content marketing further builds loyalty. A strong brand foundation is crucial for successful entry and sustained recognition in new markets.

How does market expansion for financial services contribute to risk diversification?

Market expansion in financial services enhances risk diversification by spreading operations across different geographic markets and products. This reduces reliance on a single market, stabilizes revenue streams, and mitigates local economic risks. Expanding into new markets creates multiple revenue sources, increasing business resilience. Digital innovation during expansion also broadens financial products, further diversifying risk. Geographic diversification lowers exposure to localized risks and helps firms balance risk and growth effectively.

What challenges define the landscape for market expansion in financial services?

Key Challenges for Market Expansion in Financial Services

- Regulatory Compliance: Complex and evolving rules create major hurdles.

- Technology & Fintech Disruption: Innovation outpaces regulations, causing operational strain.

- Cultural & Language Barriers: Complicate entry and customer engagement.

- Cybersecurity & Data Privacy: Risks increase with digital and geographic growth.

- Economic & Geopolitical Risks: Uncertainty affects international strategies.

- High Costs & Complexity: Banking structures make expansion costly.

- Rising Competition: New players intensify market pressure.

In short, expanding requires balancing regulatory, technological, cultural, security, economic, and competitive challenges.

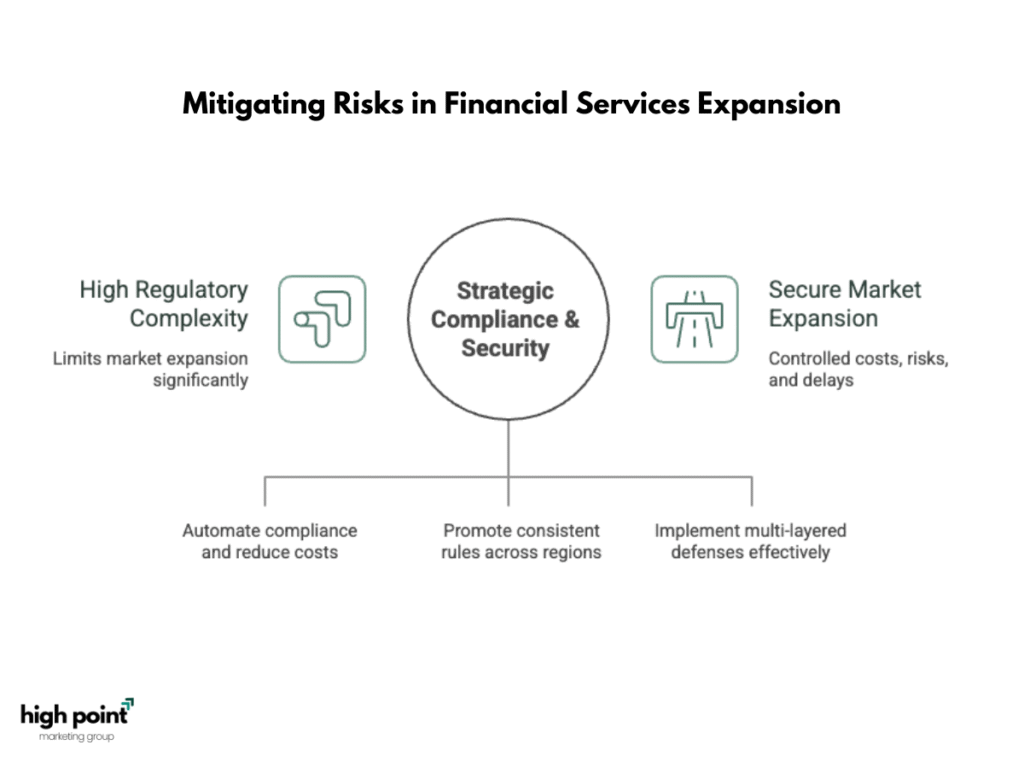

How does regulatory complexity impact market expansion for financial services?

Regulatory complexity limits market expansion by creating high compliance burdens, fragmented oversight, and inconsistent rules across regions. As financial services scale, regulatory demands grow, increasing costs, risks, and delays. Firms must adopt RegTech and plan strategically to stay compliant. Without harmonized regulations, cross-border growth remains challenging.

What are the cybersecurity risks associated with market expansion for financial services?

As financial services expand, cybersecurity risks grow significantly due to increased digital exposure, integration with third-party systems, and expanding attack surfaces. Common threats include:

- Phishing, ransomware, and DDoS attacks, which intensify during periods of growth

- AI-driven cyber threats like deepfakes and automated breaches

- Supply chain vulnerabilities from external vendors and platforms

- Weak access controls and poor authentication practices

- Rising systemic risk as firms scale without equal cybersecurity maturity

In 2024, the global cost of cybercrime reached $9.5 trillion, with the finance industry alone facing $12 billion in losses. Expansion without strong defenses can compromise data integrity, erode consumer trust, and destabilize financial systems. Market Expansion Consulting Services

Firms must adopt robust security frameworks, RegTech, and multi-layered defenses to safeguard growth.

How does competition from non-traditional players affect market expansion for financial services?

Non-traditional players like FinTechs and BigTechs disrupt financial services by offering cheaper, tech-driven alternatives, altering lending models, and increasing consumer choice. Their rise leads to:

- Lower bank profitability and shrinking loan demand

- Rapid growth of embedded finance, bypassing traditional banks

- Use of big data and alternative credit models

- Introduction of cybersecurity and data privacy risks

Banks are responding by launching digital products, creating private credit funds, and partnering with tech startups to stay competitive. Market Expansion Strategies & Planning

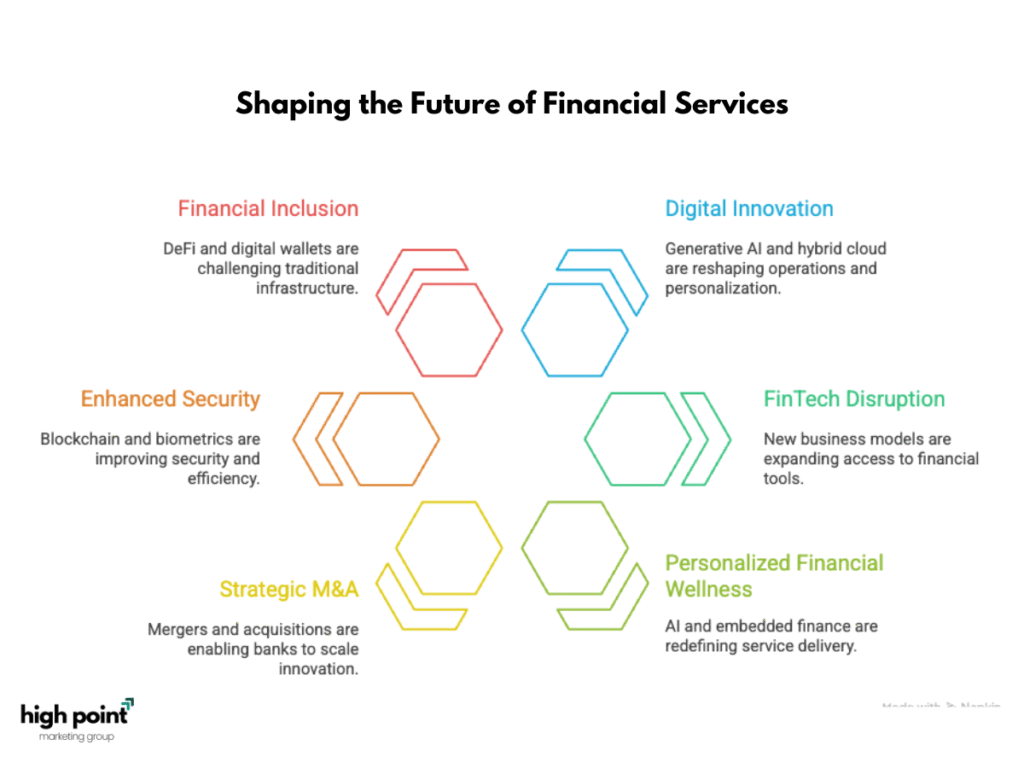

How do current industry trends shape the future of financial services?

Current trends are transforming financial services through rapid digital innovation, strategic realignment, and evolving customer expectations. Key drivers include:

- Generative AI and hybrid cloud are reshaping operations, risk management, and personalization (IBM).

- FinTech disruption introduces new business models, opening access to financial tools for both businesses and individuals (Columbia Business School).

- AI, embedded finance, and personalized financial wellness are redefining service delivery and customer engagement (RFI Global, Workday).

- Mergers & acquisitions (M&A) are enabling banks to scale innovation and enter new markets (Guidehouse).

- Adoption of blockchain, APIs, and biometrics is improving security and efficiency (Comcast Business).

- DeFi, digital wallets, and cross-border payments are challenging traditional infrastructure, encouraging greater financial inclusion.

- To stay competitive, institutions must invest in digital transformation, build trust, and partner with tech innovators.

These trends collectively point toward a customer-centric, tech-enabled, and sustainability-focused future (Capgemini).

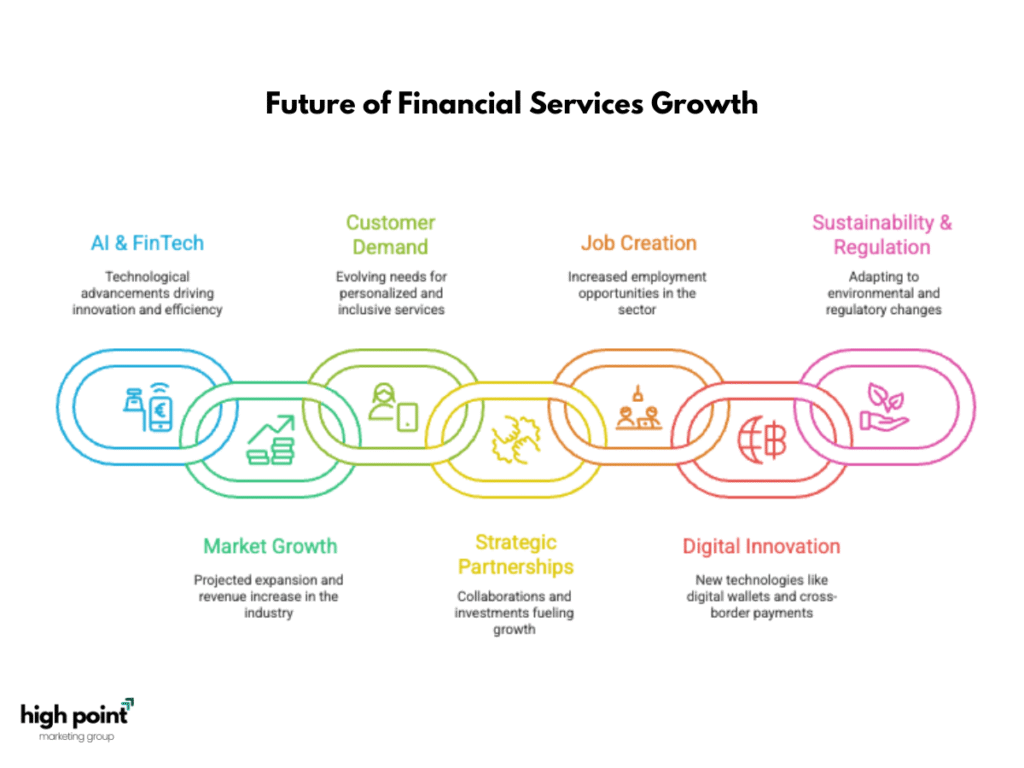

What does the future of the financial services industry mean for growth?

The future of financial services means strong growth driven by AI, FinTech, and digital transformation. Key factors include:

- 7.2% market CAGR, reaching $47 trillion by 2029

- FinTech revenues growing 3x faster than traditional banks

- Rising demand for personalized, inclusive, and efficient services

- Growth fueled by partnerships, M&A, and tech investments

- Increased financial jobs (15% growth by 2029)

- Innovations like digital wallets and frictionless cross-border payments

- Importance of sustainability and adapting to regulations

In short, growth depends on embracing technology, collaboration, and evolving customer needs.

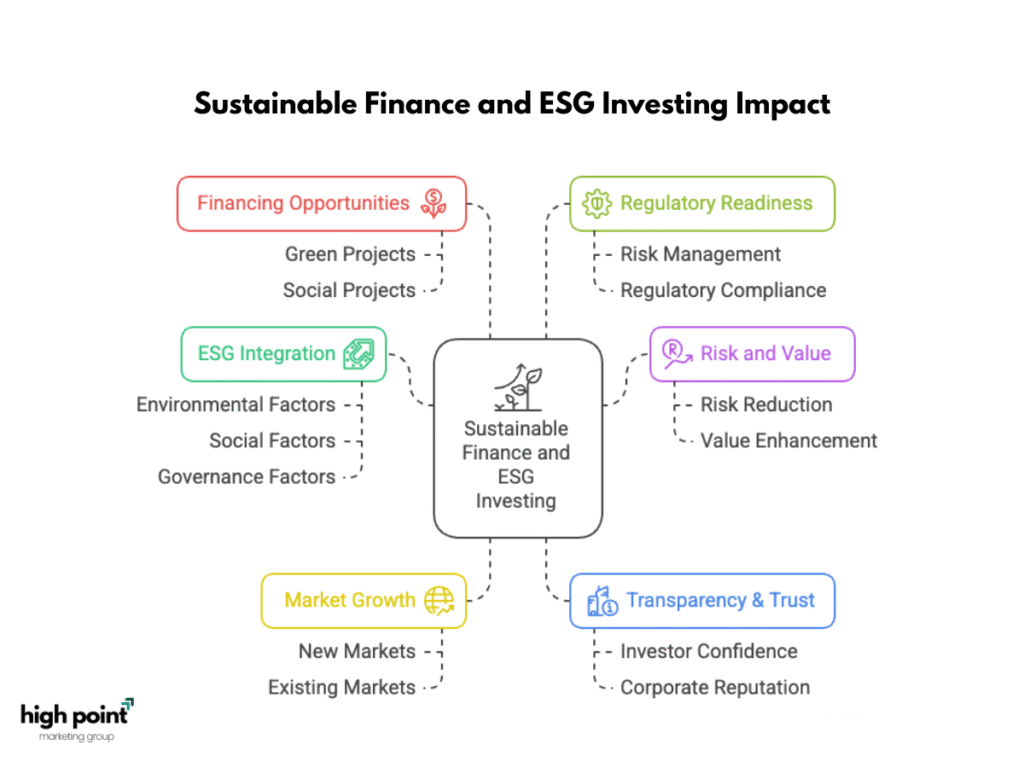

How will sustainable finance and ESG investing influence market expansion for financial services?

- ESG Integration: Incorporates environmental, social, and governance factors into investment decisions, shifting capital toward responsible activities.

- Risk and Value: Reduces risks and enhances long-term value for companies and investors.

- Market Growth: Opens new markets and expands existing ones through increased investor demand.

- Transparency & Trust: Builds investor confidence and strengthens corporate reputation.

- Financing Opportunities: Creates new funding sources by reallocating capital to green and social projects.

- Regulatory Readiness: Helps institutions manage risks and comply with evolving regulations.

Key Facts

| Fact | Detail |

| Market Size | $5.87 trillion in 2024, growing at 19.8% CAGR through 2034 |

| Assets | $160 trillion expected under sustainable mandates by 2036 |

| Cost Savings | ESG lowers funding costs for sustainable companies |

| Performance | Better efficiency, stock returns, and capital costs with strong ESG |

| Economic Impact | Drives sustainable economic development |

| Capital Flow | Channels funds to climate and social goals |

Sustainable finance and ESG investing drive financial services market expansion by steering capital to responsible investments, enhancing risk management, unlocking growth opportunities, and building investor trust, fueling rapid growth in this evolving sector.

What is the role of embedded finance in the future of the financial services industry?

Embedded finance integrates financial services into non-financial platforms, creating seamless customer experiences and new revenue streams like payments, lending, and insurance. It drives financial inclusion by reaching underserved users and boosts convenience by embedding services where customers already engage. Powered by APIs and tech collaboration, embedded finance is disrupting traditional finance, expanding markets, and enabling “invisible finance” within digital ecosystems.